TECHNOLOGY IN CAR INSURANCE

The landscape of car insurance is rapidly evolving, driven by technological advancements that are reshaping how risk is assessed and policies are tailored. For those considering insurance for a new car, understanding these innovations is crucial.

TELEMATICS: DRIVING BEHAVIOR ANALYSIS

Telematics devices, often referred to as 'black boxes', are revolutionizing how insurers evaluate risk. These small devices, installed in your vehicle, collect data on various aspects of your driving behavior:

- Speed patterns

- Braking habits

- Acceleration tendencies

- Time of day you typically drive

- Types of roads you frequently use

This wealth of data allows insurance companies to create highly personalized policies. Safe drivers can benefit from lower premiums, while those with riskier habits might see increased rates. For new car owners, opting for a telematics-based policy could lead to significant savings if you maintain good driving habits.

AI-DRIVEN RISK ASSESSMENT

Artificial Intelligence is transforming the underwriting process. Machine learning algorithms can process vast amounts of data to predict risk with unprecedented accuracy. This includes:

- Historical claim data

- Traffic patterns

- Weather conditions

- Vehicle safety features

For those insuring a new car, AI can quickly evaluate the vehicle's safety features and how they might reduce the likelihood of accidents or theft. This could result in more competitive premiums for cars equipped with advanced safety technology.

MOBILE APPS AND DIGITAL PLATFORMS

Insurance companies are increasingly offering mobile apps that provide a range of services:

- Real-time policy management

- Instant claim filing with photo evidence

- Direct communication with insurance agents

- Personalized driving tips

These apps not only make managing your policy more convenient but can also offer insights into your driving habits, helping you become a safer driver and potentially reduce your premiums.

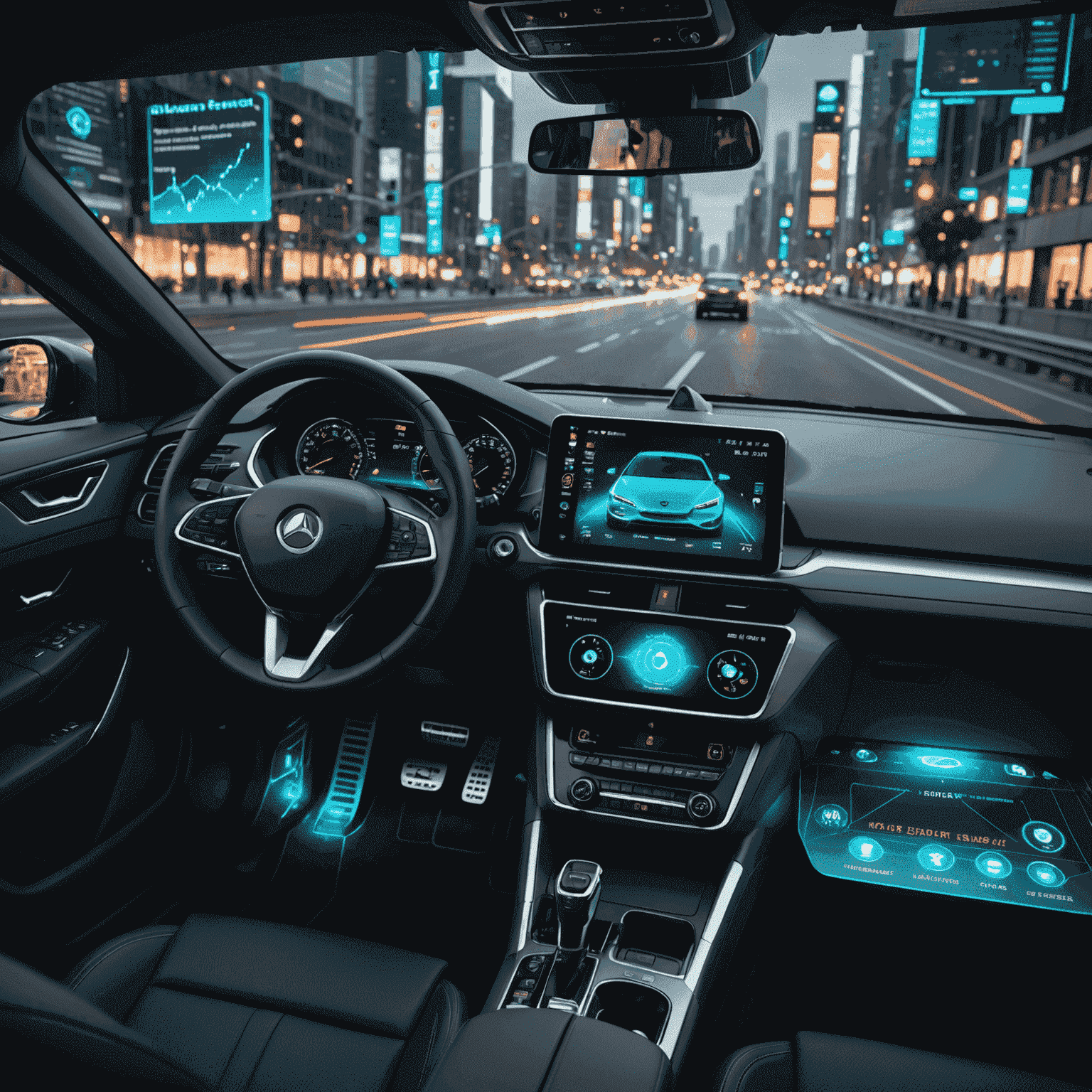

CONNECTED CARS AND INSURANCE

Modern vehicles are increasingly connected, capable of transmitting data directly to insurers. This connectivity allows for:

- Automatic accident detection and reporting

- Predictive maintenance alerts

- Real-time tracking in case of theft

If you're insuring a new car with these capabilities, you might benefit from faster claim processing and potentially lower premiums due to the reduced risk of prolonged damage or total loss.

CONCLUSION

As technology continues to advance, the car insurance industry is becoming more sophisticated in its approach to risk assessment and policy creation. For those looking to insure a new car, these technological innovations offer the potential for more personalized, fair, and flexible insurance options. By embracing these technologies, drivers can potentially benefit from lower premiums, faster claim processing, and an overall improved insurance experience.

Remember, when considering insurance for your new car, inquire about these technological options. They could significantly impact your coverage and costs, ensuring you get the most value from your car insurance policy.